Investing

Send Help, I’m Trying To Thrive In This Economy

This content is brought to you by Prudential Singapore. How long have you rejected the things you enjoy because of money?A glass of matcha latte?A nice and aesthetic brunch?A holiday you desperately need after so many stressful months?As a working mother of two, brunches and matcha lattes used to soothe me after days of parenting. Those were the moments when I could sit back and recharge myself in peace.#emotionalhealingHowever, they were getting more expensive. As expenses began to rack up, the less I got to enjoy my “matcha latte” moments. Every month, I could only watch my bank balance go down after every expense and meal. Self-care began to feel like a luxury subscription to me.To save up, that one hour of peace I used to look forward to every week has slowly turned into a once-a-month luxury.At one point, just existing was already expensive for me. The feeling of being held back from my “matcha latte” moments was suffocating because I thought there was no other way for me to experience peace and joy.So, I tried to shift my fulfilment elsewhere. I began to relook my priorities and focus on small joys. A cup of home-brewed sencha tea in the morning, having heart-to-heart talks with my children, or a small 30-minute window of financial planning. Looking for options that provide security and growthAs I envisioned my goals, I realised that my $25 weekly “matcha latte” moments could not compare to the bigger dreams I want for my family. I want a one-year break so I can spend more time with my kids and take them on trips. I wish to save enough money from them to study overseas and see the world. And above everything else, I want a peaceful retirement with no financial worries. I started to look for other ways to grow my money without the stress of constantly monitoring the market for ups and downs. Stocks and REITs felt too volatile for my risk appetite, and I was also looking for something that offered growth to keep up with inflation.That was when I discovered index-linked income solutions, which are financial products that combine stability with growth potential. They tap into index performance to generate payouts while keeping my savings protected. These plans provide monthly payouts with market-linked returns, helping my savings grow alongside my family’s future goals. The flexibility in premium terms lets me choose an option that best fits our family’s budget, and I can even switch indices based on my preferences. Most importantly, my savings are protected by a floor rate, giving me reassurance during market downturns. After speaking about the index-linked income solutions with my trusted financial representative, I felt confident knowing how these solutions align with my goals. I still enjoy the occasional “matcha latte” moments, but I’ve come to realise that planning for my family’s financial future has somehow brought me a peace of mind that I could never replace. Sponsored content by Prudential SingaporeDon’t deny yourself the future you want. Start growing your “Yeses” today! Prudential offers income generating solutions that will support long-term growth for your savings while protecting your loved ones’ future.PRUIndex Income BoostThis Singapore-dollar regular premium participating endowment plan taps into index growth1 to generate income while safeguarding your savings.Receive guaranteed Monthly Cash Benefits of 2.3%2 p.a.from 1st to the 12th month. Potential to receive payouts linked to the market1 from the 13th month onwards, and a non-guaranteed maturity bonus once the policy ends. Savings protected from market downturns with 0.0% floor rate while enjoying capital guarantee at maturity3 in fifteen years.Choose your preferred premium term: 5 or 10 yearsFlexibility to switch indices and accumulate your Monthly Cash Benefit at an interest rate4 during the payout period.Provides death protection.PRUIndex Lifetime IncomeA Singapore- and US-dollar regular premium whole life participating plan that provides guaranteed income for life, with potential for higher payout depending on index growth1. From 1st month, start receiving guaranteed Monthly Cash Benefits of 0.50%2 p.a. for lifetime.Potential to receive payouts linked to the market1 from13th month onwards.Savings protected from market downturns with 0.0% floor rate.Choose your preferred premium term: 5, 7, 10, 15 yearsFlexibility to switch indices and accumulate your Monthly Cash Benefit at an interest rate4 during the payout period.Support your family across generations through Wealth Share, appointing a Secondary Life Assured and change of Life Assured.Provides death protection.Disclaimer: You are recommended to read the product summary and seek advice from a qualified Prudential Financial Representative for a financial analysis before purchasing an insurance policy suitable to meet your needs. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic, and no further action is required from you.This advertisement has not been reviewed by the Monetary Authority of Singapore.

A Millionaire At 39, But Money Didn’t Make Me Happy

Arrr You Ready To Collect Gold Coins? Keep Your Booty Safe With These Tips

ETFs Explained: Because You Don’t Need to Be A Finance Bro To Invest

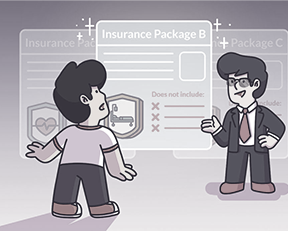

New To Investing? Here Are Some Power Moves

How I’m Protecting My Money In Uncertain Times

POV: I Finally Opened My First Trading Account, And I’m Preventing My Trades From Going Wrong

Interest Rates Are Dropping. Here’s Where To Park Your Cash Instead

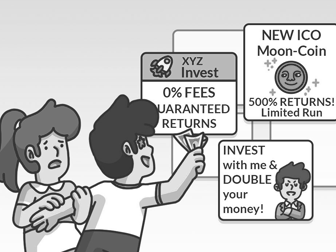

Not Everything That Glitters Is Gold

SG60: Investments Singaporeans Can’t Get Enough Of (And Why)