Latest Posts

Are You Struggling To Switch From Remote To Office Days?

Hybrid work is great, but switching between WFH and office can be tough. How do you handle it?

10 Jan 2025

READ MORE0

How To Tidy Your House for New Year Using the KonMari Method

09 Jan 2025

0

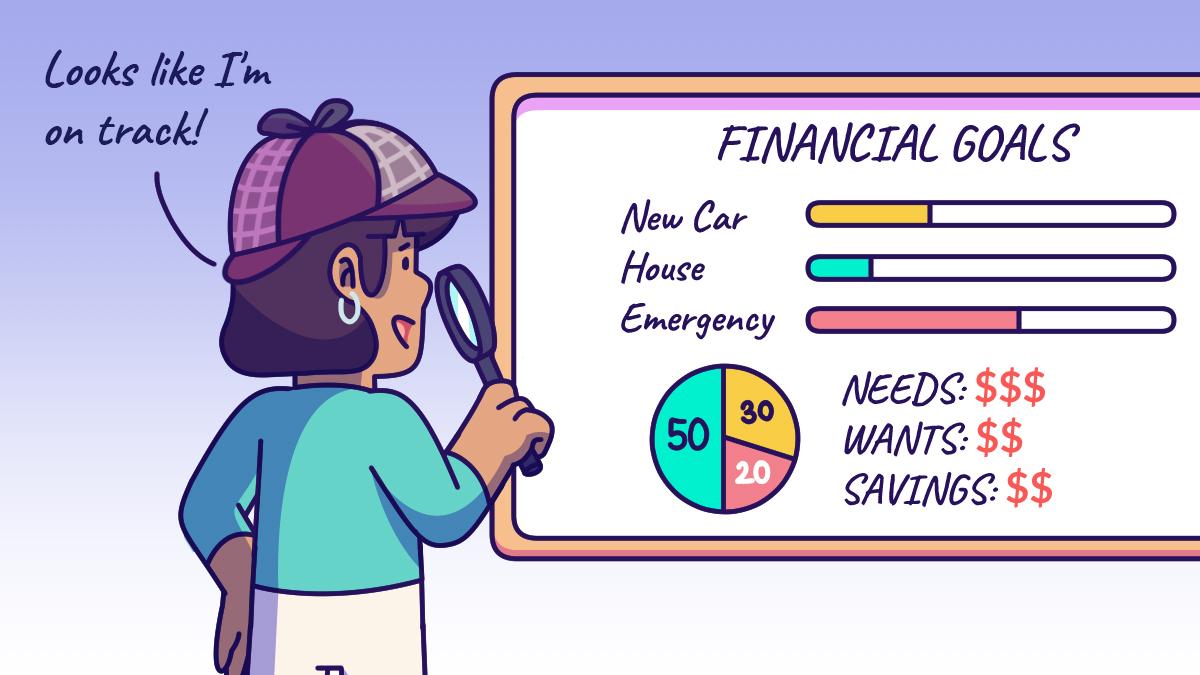

Want To Set Your Financial Goals? Here Are Six Pro Tips

08 Jan 2025

0

Don't Let Your Ego Tell You What To Do With Your Money

07 Jan 2025

0

I Couldn’t Escape The Monday Blues Until I Discovered Bare Minimum Mondays

06 Jan 2025

0

How Your Salary Affects Your Saving Goals

03 Jan 2025

0

5 Tips To Refresh Your Home In The New Year

02 Jan 2025

0

Being Kiasu Can Help You Get Ahead of Your Finances

31 Dec 2024

0

I Never Thought My New Year's Party Gift Would End Up Like This

30 Dec 2024

0

Give From The Heart, Not From The Wallet

27 Dec 2024

0

SUBSCRIBE

STAY UPDATED!

And join our community© Copyright 2025 The Simple Sum. All Rights Reserved.